News

European Juice-Makers Offer Vegetable Innovation

5 Jun 2012The Mintel Inspire trend A Simple Balance for Health maintains that “simple, uncomplicated habits are always a good option. Sticking with the basics is a surefire way for brands to score with health-seeking consumers.” In the juice segment, vegetable blends are one example of a back-to-basics approach. They balance out the need for both fruit and vegetables, […]

The Mintel Inspire trend A Simple Balance for Health maintains that “simple, uncomplicated habits are always a good option. Sticking with the basics is a surefire way for brands to score with health-seeking consumers.”

In the juice segment, vegetable blends are one example of a back-to-basics approach. They balance out the need for both fruit and vegetables, and as consumers a growing number of countries face obesity issues, vegetables’ lower sugar and calorie levels offer an option for keeping those factors in check.

In Europe, vegetable juice introductions are back on the rise after dropping considerably for several years. Juices that use vegetable as a flavor component (which excludes products that contain vegetable juice and extracts only for natural color) fell by more than half between 2007 and 2010. But they began climbing again last year, and this year have already seen nearly as many introductions as all of last year.

Spain, Italy, Belgium and the Czech Republic all have increased their share of Europe’s vegetable juice introductions during the past two years. Germany has retained its position at the top of the list, although its share of overall introductions in the region dropped slightly.

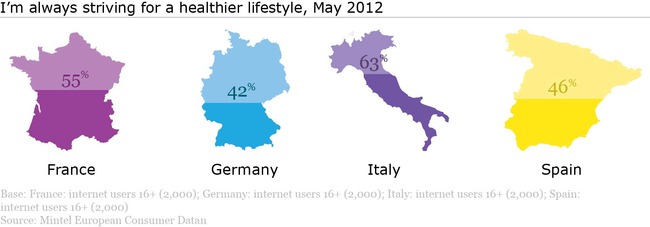

Consumers in Europe report that they are trying to live healthier. In fact, more than half (55%) of consumers in France and a nearly two-thirds of those in Italy say they are always striving for a healthier lifestyle. Those percentages are slightly lower for Germany and Spain (42% and 46%, respectively), but still significant. That seems to offer a chance for juice to promote vegetable content as well as fruit for a wider range of nutrients.

While a number of the new European vegetable juice rollouts are veg-only, fruit and vegetable blends continue to become more popular. So far this year, fruit, citrus fruit and berry blends have accounted for 63% of introductions.

Carrot is the go-to vegetable for blends, accounting for 46% of the products introduced in Europe so far this year. That’s followed by tomato, which can be found in 26% of introductions in 2012. Beetroot accounts 9% of introductions so far this year, building on the vegetable’s growing reputation for lowering blood pressure, increasing stamina and athletic performance, and fighting inflammation.

Like consumers in most regions, European consumers report that they find it difficult to get the recommended five servings of fruits and vegetables a day. Interestingly, at 61%, consumers in Germany are among the most likely to say they struggle to meet their five-a-day. That means despite the number of vegetable-based juices on the market, consumers are not seeing them as part of their consumption goals. Juice-makers seem to be missing the opportunity to tie their vegetable juice products to these goals.part of their consumption goals.

Consumers across Europe report swapping out less-healthful snacks for fruits and vegetables, but some still prefer their veg to be blended in with something else rather than consumed straight up. Not surprisingly, younger consumers are most likely to say they prefer vegetables blended into smoothies or soup. In Italy, 29% of those under age 25 prefer consume vegetables this way, as do 28% of under-25s in Spain and 21% in Germany. That leaves potential for juice-makers that can appeal to these younger consumers by blending the vegetables they know they should be eating into a more preferred format.

As consumers become more comfortable and familiar with vegetable-based juices, drink-makers can look to the East for new concepts. Japan and China are the two leading vegetable juice innovators globally, with Japan accounting for 13% of global introductions so far this year and China 9%.

Related news

Oat Barista: Innovation for game-changing beverages

20 Nov 2025

Oat Barista is a clean label, sustainable, and innovative drink base specifically designed to create the perfect foam in one single ingredient.

Read more

How younger consumers are redefining ingredient choices and rejecting brand loyalty

18 Nov 2025

Gen Z and millennial consumers’ preferences for transparency, functionality, and purpose are “redefining the very nature of consumption itself”, says SPINS.

Read more

Hybrid formats and flexible positioning to disrupt category norms in 2026

17 Nov 2025

Trend forecasters expect food and drink to move more fluidly across occasions, functions, and formats as consumers seek versatility, novelty, and convenience.

Read more

Danone highlights digestive health as potential ‘tipping point’ for food industry

13 Nov 2025

Danone is betting on a food industry “tipping point” that will bloat the market for healthy products, particularly those related to gut health.

Read more

New UPF standard hoped to offer consumers ‘coherence and clarity’

10 Nov 2025

Ingredients companies are being urged to enter “a new era of partnership and innovation” following the launch of the industry’s first non-UPF verification scheme.

Read more

Faravelli at Fi Europe: Showcasing FARA® functional solutions for food and nutra

28 Oct 2025

At Fi Europe 2025 in Paris (stand 72M39), Faravelli showcases FARA® Customized Functional Solutions and a wide ingredient portfolio for food and nutra – delivering quality, innovation, and expertise.

Read more

Agrigum Redefined FIBER

27 Oct 2025

Agrigum has transformed gum acacia into a natural, science-backed fibre that supports gut health, sustainability, and innovation across global food and nutrition applications.

Read more

Expanding boundaries in food & beverage innovation

23 Oct 2025

IMCD and FrieslandCampina Professional expand partnership to deliver Kievit® across EMEA, enabling brands to enhance quality and accelerate time-to-market for tomorrow’s food & beverage creations.

Read more

Amazon Grocery launch aims to balance quality with affordability

22 Oct 2025

Global e-commerce giant Amazon has introduced a new private-label food brand, combining existing Amazon Fresh and Happy Belly products with new everyday items.

Read more

Powerade enters hydration space with launch of Power Water

21 Oct 2025

Coca-Cola’s Powerade brand has launched a zero-sugar, electrolyte-enhanced functional water, marking the brand's entry into the hydration space.

Read more